The economic situation of the Russian Empire underwent serious changes as World War I broke out. The hopes that the war would be over in a matter of weeks or months were not fulfilled. The army needed large quantities of arms, food and uniforms. Serious measures were to be taken to meet these challenges.

The government had to suspend the exchange of paper notes for gold and expand the issue of banknotes in order to cover expenditure. This led to devaluation of money supply and depreciation of the ruble. Another way of accumulating funds was the issue of government bonds, one of the most common financial operations in all European countries. During the First World War this practice became even more widespread, as all countries were short of money. The Russian Empire was no exception, as it wanted to raise as much money as possible to support the combat army.

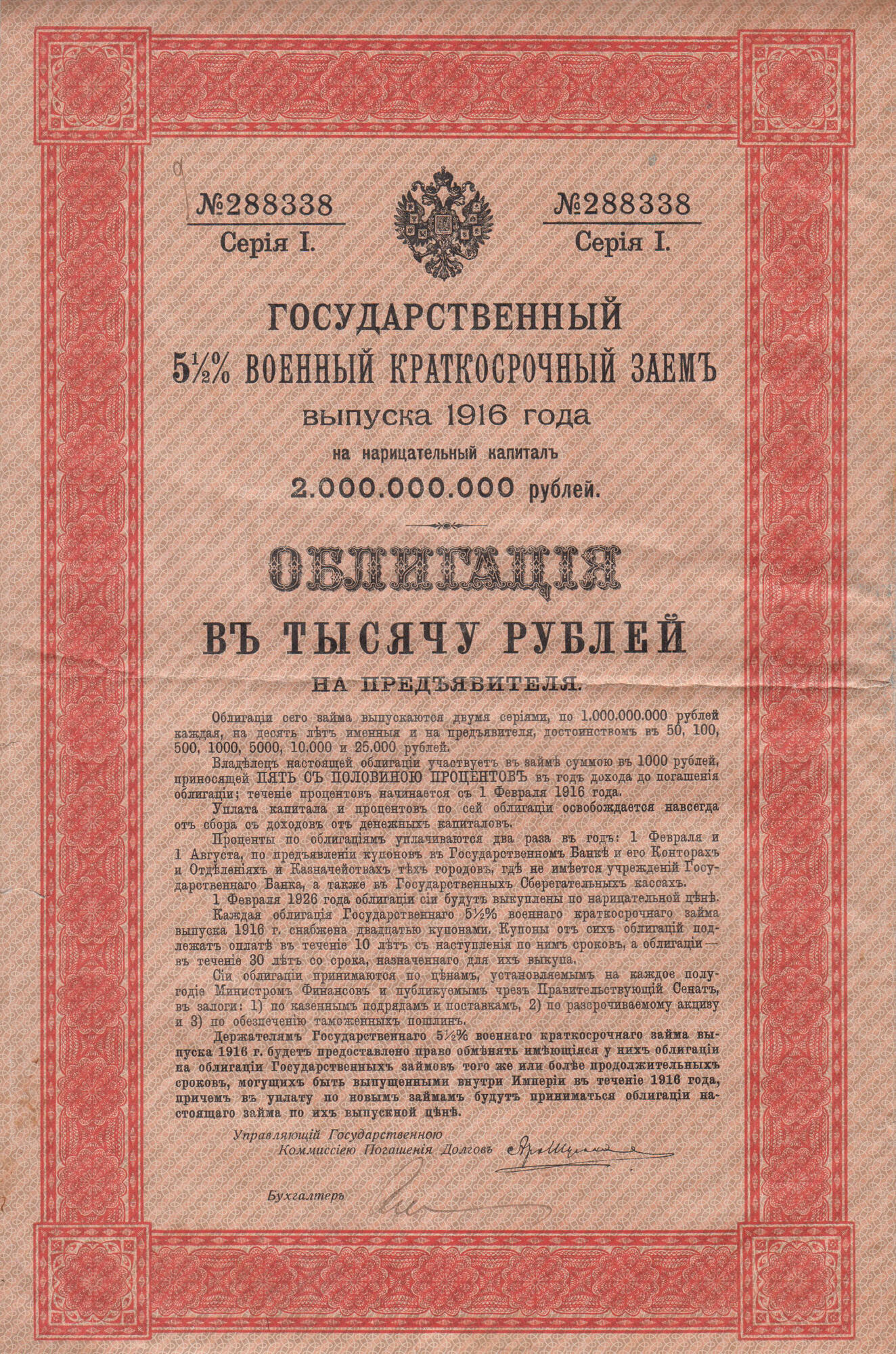

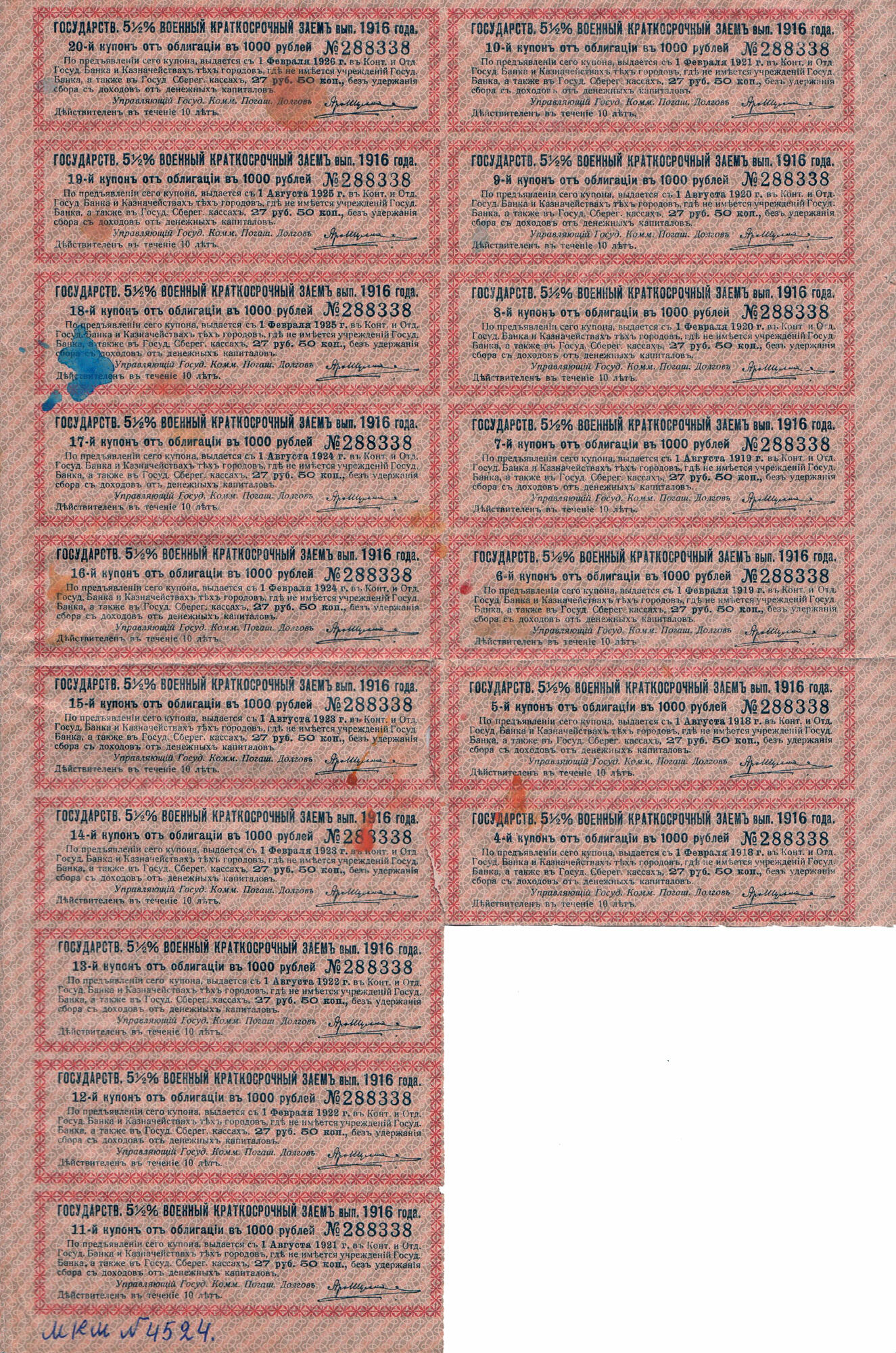

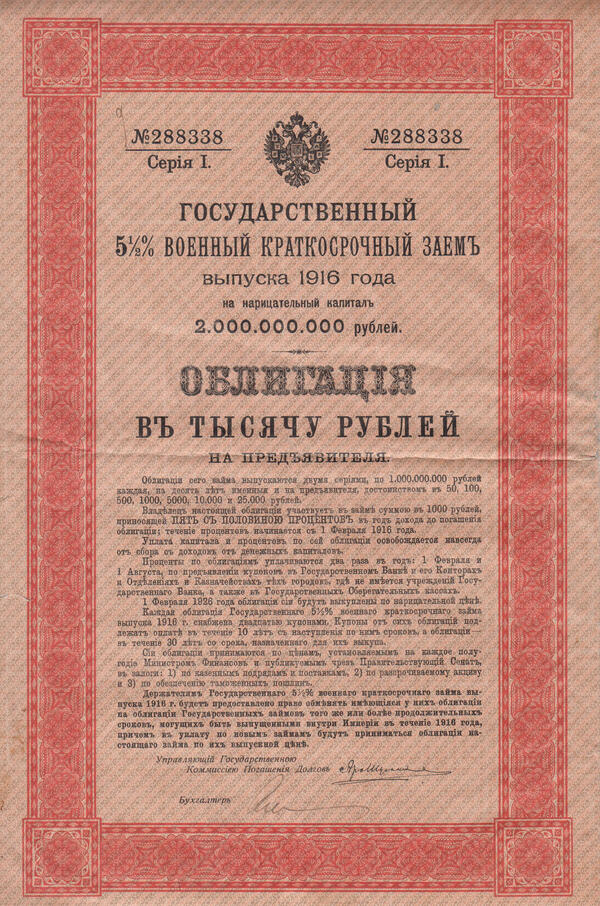

In 1915, 5.5% loan bonds were issued for ten years. The total amount was 1 billion rubles. In 1916, there were two issues of bonds, for 2 and 3 billion rubles. The debt was to be repaid in installments: every six months, the owner of the bond would receive 2.75% of the bond’s face value. Each bond had twenty coupons, one of which was torn off when the six-month debt was paid off. It was assumed that after all the interest was paid off, the bondholder would receive the amount of the down payment. In the case of the present bond, this was to happen in 1926. The payment of interest on these bonds was continued by the Provisional Government after the February Revolution. However, after the Bolsheviks came to power, deposits in empire securities were declared invalid and payments on them ceased. Nevertheless, the bonds and redeemed coupons became the official means of payment from 1918.

The three coupons on the bonds are missing, which is typical: owners of these securities had only three opportunities to receive interest before payments on them ceased. The coupons show traces of children’s paint. No longer a means of payment, when the monetary system in post-revolutionary Russia gained strength, the bonds became worthless pieces of paper.

The government had to suspend the exchange of paper notes for gold and expand the issue of banknotes in order to cover expenditure. This led to devaluation of money supply and depreciation of the ruble. Another way of accumulating funds was the issue of government bonds, one of the most common financial operations in all European countries. During the First World War this practice became even more widespread, as all countries were short of money. The Russian Empire was no exception, as it wanted to raise as much money as possible to support the combat army.

In 1915, 5.5% loan bonds were issued for ten years. The total amount was 1 billion rubles. In 1916, there were two issues of bonds, for 2 and 3 billion rubles. The debt was to be repaid in installments: every six months, the owner of the bond would receive 2.75% of the bond’s face value. Each bond had twenty coupons, one of which was torn off when the six-month debt was paid off. It was assumed that after all the interest was paid off, the bondholder would receive the amount of the down payment. In the case of the present bond, this was to happen in 1926. The payment of interest on these bonds was continued by the Provisional Government after the February Revolution. However, after the Bolsheviks came to power, deposits in empire securities were declared invalid and payments on them ceased. Nevertheless, the bonds and redeemed coupons became the official means of payment from 1918.

The three coupons on the bonds are missing, which is typical: owners of these securities had only three opportunities to receive interest before payments on them ceased. The coupons show traces of children’s paint. No longer a means of payment, when the monetary system in post-revolutionary Russia gained strength, the bonds became worthless pieces of paper.