Alexander II was the emperor of the Russian Empire from 1855 till 1881. His reign was marked by such important events as the abolition of serfage, liberalization, development of railway network. Changes in market relations and economic situation let to necessity to change the structure of the public loan. In connection with that such phenomenon as the lottery bonds appeared in the Russian Empire.

The first experience of issuing the 5% credit notes for the domestic loan took place in 1864. The part of the proceeds was spent on construction of the railways. The state bank paid the interest payment in all their offices and branches to the coupon holders even when the applicants didn’t have the notes. For the state it was profitable to enrich the treasury at the cost of inner funds instead of financing from the European banks.

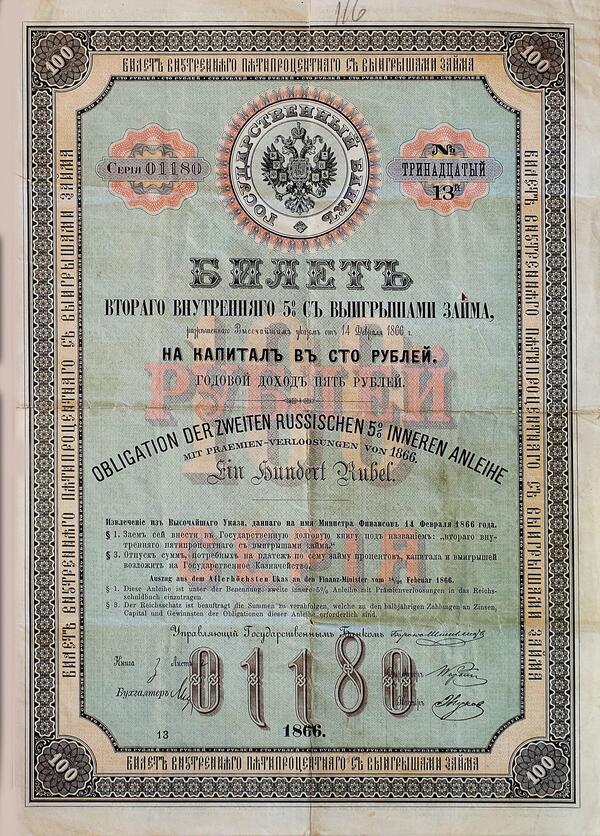

The full title of the credit notes was the Notes for the Domestic Five Percent Profit-Oriented Loan. Except for the decree on their issue the special statement with conditions and annotations was published. It was marked that the notes were to be in operation for 60 years. Along with that the special coupon marking the sum of annual payment was given along with the ticket.

The Second Note for the Domestic Five Percent Profit-Oriented Loan, also for the sum of 100 million roubles was issued in 1866 following the success of the first issue. Like previously, the state bank assumed obligation to pay the annual percentage during 60 years, and each buyer of a credit note got the possibility to participate in the lottery and had a chance to win a certain amount of money.

The special committee with representatives from nobility, trade, state control, and deputies from different social groups was gathered at the days of the lottery. At the end of the event the print house of the state bank issued the tables with the lottery results, which heightened the public’s interest even more. In the course of time credit notes gained much success among different social groups, which let the bank motivate not only aristocracy, but also middle class to purchase definitive securities.

However, in spite of the success of the operation for some clients, there was the other side as well. A massive speculation appeared. The bankers brought in the installment system, as a result the client had to pay extra money for the credit note. Considering the population’s lack of expertise and hope to get easy money, the people interested in getting the notes by such scheme went in for minimum initial rate not considering the serious overpayment in the future. For the banks such scheme was profitable as well, just like the implemented insurance of the winning loans, which brought them much profit.

The Council of People’s Commissars of the Soviet Russia put an end to the loans of no longer existing state structure with the decree on January 21, 1918.

The first experience of issuing the 5% credit notes for the domestic loan took place in 1864. The part of the proceeds was spent on construction of the railways. The state bank paid the interest payment in all their offices and branches to the coupon holders even when the applicants didn’t have the notes. For the state it was profitable to enrich the treasury at the cost of inner funds instead of financing from the European banks.

The full title of the credit notes was the Notes for the Domestic Five Percent Profit-Oriented Loan. Except for the decree on their issue the special statement with conditions and annotations was published. It was marked that the notes were to be in operation for 60 years. Along with that the special coupon marking the sum of annual payment was given along with the ticket.

The Second Note for the Domestic Five Percent Profit-Oriented Loan, also for the sum of 100 million roubles was issued in 1866 following the success of the first issue. Like previously, the state bank assumed obligation to pay the annual percentage during 60 years, and each buyer of a credit note got the possibility to participate in the lottery and had a chance to win a certain amount of money.

The special committee with representatives from nobility, trade, state control, and deputies from different social groups was gathered at the days of the lottery. At the end of the event the print house of the state bank issued the tables with the lottery results, which heightened the public’s interest even more. In the course of time credit notes gained much success among different social groups, which let the bank motivate not only aristocracy, but also middle class to purchase definitive securities.

However, in spite of the success of the operation for some clients, there was the other side as well. A massive speculation appeared. The bankers brought in the installment system, as a result the client had to pay extra money for the credit note. Considering the population’s lack of expertise and hope to get easy money, the people interested in getting the notes by such scheme went in for minimum initial rate not considering the serious overpayment in the future. For the banks such scheme was profitable as well, just like the implemented insurance of the winning loans, which brought them much profit.

The Council of People’s Commissars of the Soviet Russia put an end to the loans of no longer existing state structure with the decree on January 21, 1918.